Introduction

FSRA is seeking input from consumers, pension plan beneficiaries, regulated entities, and other interested stakeholders on its proposed multi-year Approach to Strengthening Protection of Vulnerable Consumers (Section A) as well as its proposed definition of vulnerable consumers (Section B). For those interested, FSRA has developed a list of questions to help guide their consultation submission (Section C). The approach will be developed and finalized based on engagement with consumers, pension plan beneficiaries, regulated entities, and other interested stakeholders.

Issue

Research undertaken by the Financial Services Regulatory Authority of Ontario (FSRA) shows that in all its regulated sectors, vulnerable groups tend to be less trusting, less satisfied, and less confident. Other findings through FSRA’s supervisory work have provided evidence that vulnerable consumers experience poorer outcomes. They are at greater risk of being susceptible to harm, such as fraud. They may also experience more issues getting products or services in certain sectors, especially products and services that are right for them. See Appendix 1 for key findings.

Leading Canadian and international regulators are exploring and implementing changes targeted specifically at improving financial outcomes for vulnerable consumers. See Appendix 2 for examples.

FSRA has taken significant steps to improve safety, fairness, and choice in its regulated sectors for all Ontarians, including vulnerable consumers. The steps involve new standards for conduct of business in different sectors that provide a strong foundation for fair treatment of consumers overall, but do not consistently speak to expectations for fair treatment of vulnerable consumers. See Appendix 3 for examples.

FSRA’s response

What FSRA has heard from consumers, found in its supervisory work and seen from other regulators indicate there is an opportunity to do more in protecting the interests and rights of vulnerable consumers.

FSRA has undertaken the development of an Approach to Strengthening Protection of Vulnerable Consumers. FSRA’s proposed approach is focused on closing the gap between the experiences of vulnerable consumers and non-vulnerable consumers in the sectors it regulates. Consumers are those who purchase or benefit from products and services delivered by the sectors that FSRA regulates, including pension plan beneficiaries and credit union members. Closing the gap aligns closely with FSRA’s statutory objects, including:

- contribute to public confidence in the regulated sectors

- promote public education and knowledge about the regulated sectors

- promote high standards of business conduct in financial services

- protect the rights and interests of financial services consumers

- protect and safeguard the pension benefits and rights of pension plan beneficiaries

Measurement and evaluation will form an important part of FSRA’s approach to strengthening protection of vulnerable consumers. FSRA will track vulnerable consumer outcomes through a number of different tools, including continued consumer survey research that uses the current state as a baseline for tracking progress.

Section A: FSRA’s proposed approach to strengthen protection of vulnerable consumers

Overview of proposed approach

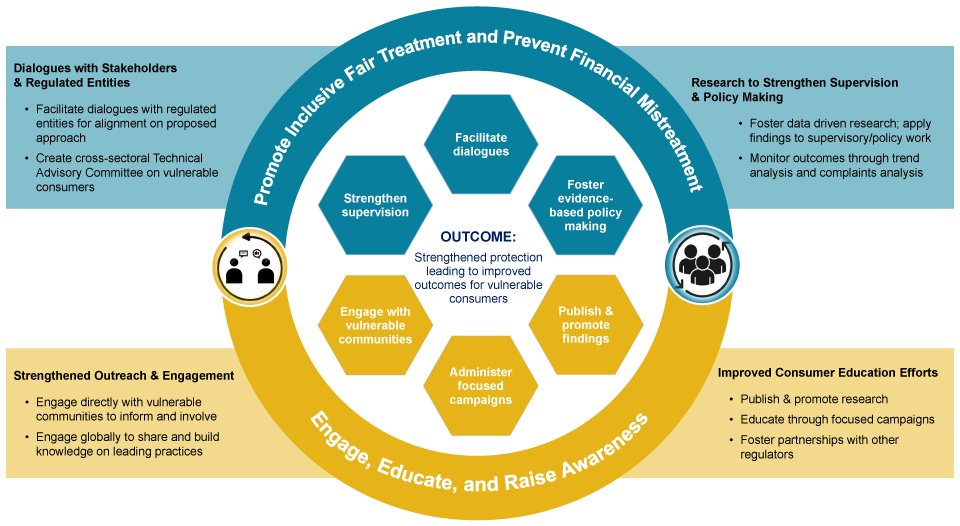

Goals and activities expected to be delivered under the proposed approach:

| Goals | Actions |

|---|---|

|

1. Promote inclusive and fair treatment of vulnerable consumers and prevent targeted financial mistreatment

|

|

|

2. Improve consumer education, engagement, and awareness building efforts

|

|

Section B: FSRA’s proposed definition of vulnerable consumers

Why a definition is important?

Before FSRA moves ahead with the proposed approach, there is a need to agree on a definition to ensure all are on the same page and aligned. A definition will ensure a shared understanding amongst FSRA, its regulated entities, its stakeholders and the public, allowing FSRA to achieve its goals of empowering and protecting vulnerable consumers. The proposed definition of vulnerable consumers can also help FSRA collect better data and evidence to understand and monitor outcomes for vulnerable groups and identify opportunities for improvement.

FSRA’s proposed definition

The following is proposed to define vulnerable consumers in FSRA’s regulated sectors:

A vulnerable consumer is someone who is at higher risk of experiencing financial mistreatment, hardship, or harm, due to various factors and personal circumstances.

The Autorité des Marchés Financiers’ “Protecting Vulnerable Clients” Guide states that vulnerability may make clients more susceptible to financial mistreatment; for instance, there is financial mistreatment when a person pressures a client to invest in a product that is not suited to the client’s needs or financial goals.

While it is difficult to describe every circumstance that may contribute to driving vulnerability, certain factors may increase an individual’s risk of becoming a vulnerable consumer. These factors include: an individual’s age, poor health condition (mental and physical), lack of financial literacy, being a recent immigrant to Canada and/or having language barriers, experiencing major life-changing events, having low financial resilience[1], lack of accessibility and availability to financial products/ services, being a member of equity deserving groups[2](such as based on an individual’s ethnic background[3]), and experiencing natural disasters / catastrophes or other major environmental events.

It is also important to recognize that vulnerability can be short-term, and external factors such as economic volatility can cause otherwise non-vulnerable individuals, regardless of their wealth or income, to become vulnerable consumers.

Section C: Specific input requested from stakeholders

Below are some guiding questions to seek your feedback on FSRA’s proposed approach to strengthen protection of vulnerable consumers, as described in the sections above. FSRA would like your thoughts on these questions or any other input on its proposed approach.

- To what extent does this topic require more attention from FSRA?

- In addition to the activities proposed in the chart under Section A, are there any additional activities, such as outlining a set of expectations or defining specific requirements for entities across all of its regulated sectors, that FSRA should consider for its approach to strengthening protection of vulnerable consumers?

- Do you have any comments on FSRA’s proposed approach to defining vulnerable consumers in Section B? Do you think it is useful to have a definition of vulnerable consumers? Are there any other factors that FSRA should consider in better understanding vulnerability in its sectors?

- If you are a consumer or consumer advocate, what should FSRA know about the experiences of vulnerable consumers?

- If you are from one of FSRA’s regulated sectors, what should FSRA know about how you, your firm, or your industry serves marginalized, underserved, and/or vulnerable consumers? For example, do you have any targeted programs or communications tactics or controls in place to reduce risk of unfair outcomes for these groups?

- What additional information, (such as leading practices, tools, opportunities or risks) should FSRA be considering to inform its approach?

- Do you have suggestions for particular vulnerable communities or public interest groups representing vulnerable consumers that FSRA should directly engage with?

Appendix 1: Findings on vulnerability from FSRA research and supervisory work

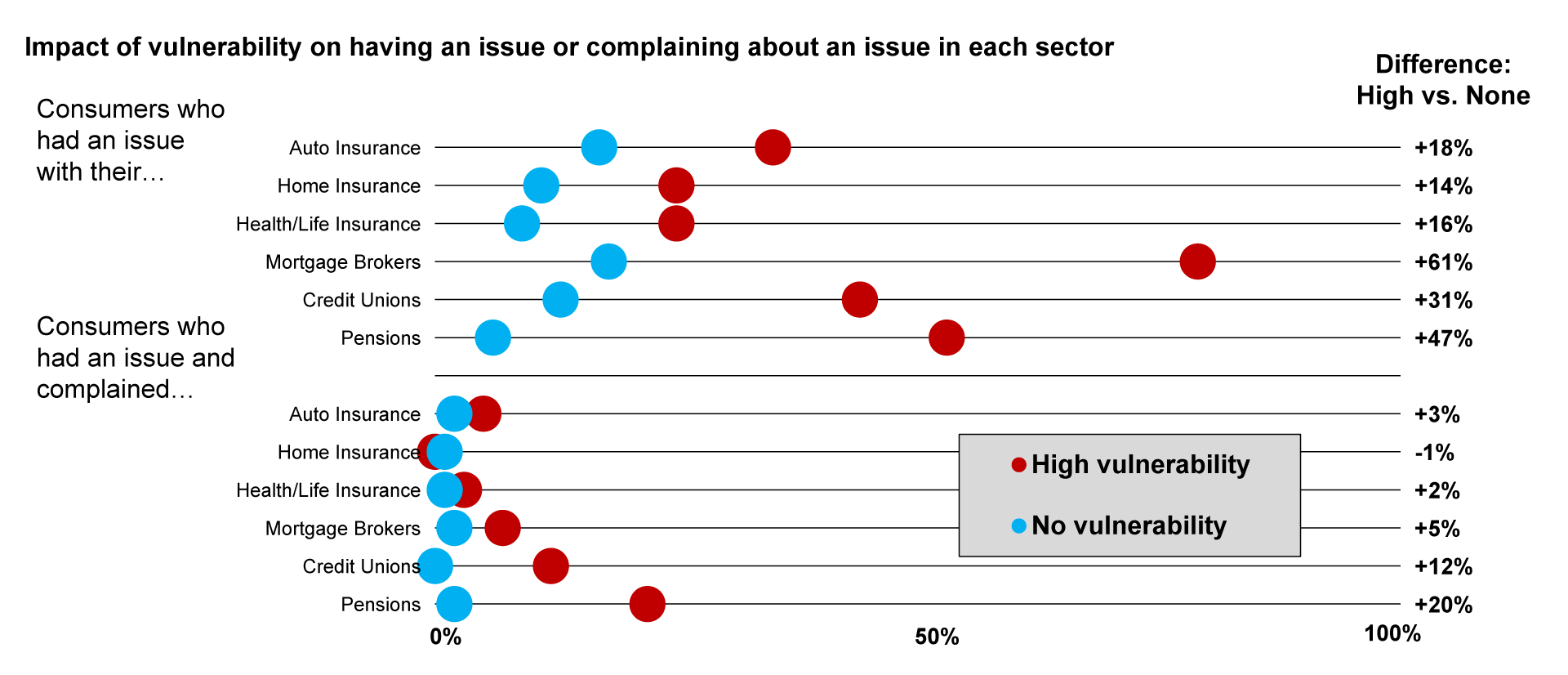

FSRA conducted its 2022 consumer research study to better understand consumer attitudes, knowledge and behaviors, and characteristics of vulnerability. The study found that while vulnerable consumers are more likely to face issues, in many sectors they are also less likely to complain about those issues. The study also found that vulnerable consumers are more likely to report experiencing barriers, such as poor customer service, a lack of empathy, and a lack of clear information.

Vulnerable Ontarians encounter problems when dealing with financial service providers far more frequently

| Percentage of respondents who selected each response | Total | Vulnerability | |||

|---|---|---|---|---|---|

| None | Slight | Moderate | High | ||

| Poor customer service | 16% | 11% | 17% | 23% | 29% |

| Slow to respond | 14% | 11% | 14% | 21% | 21% |

| A lack of empathy | 10% | 6% | 11% | 18% | 24% |

| Failing to treat you with respect | 7% | 4% | 6% | 12% | 18% |

| Processing errors | 8% | 6% | 8% | 12% | 7% |

| Lack of clear information | 11% | 8% | 11% | 15% | 31% |

| Not able to provide help needed | 8% | 6% | 9% | 11% | 20% |

| No single point of contact | 6% | 5% | 7% | 8% | 12% |

| Other | 1% | 1% | 1% | 1% | 2% |

High vulnerability groups are likelier to experience issues, but only in some sectors does this translate to more complaints

FSRA undertook further consumer research studies in 2023 in its mortgage brokering and financial advice sectors. The mortgage brokering study found that highly vulnerable consumers in the sector and those with less predictable income/employment are significantly more likely to use a mortgage broker and consider alternative and private mortgages than those with high vulnerability being less likely to qualify at financial institutions. The financial advice study found that vulnerable groups are less likely to work with a financial professional even though they have a need for financial advice. They also do not believe they have the same knowledge and confidence to make their own financial decisions compared to less vulnerable groups.

FSRA will continue to use a number of different tools, including consumer survey research, to listen to consumers about their experiences in its regulated sectors.

FSRA has obtained further evidence on outcomes of vulnerable consumers through its supervisory activities. For example, a review[4] of Managing General Agencies (MGAs) in the Life & Health Insurance sector identified potential market conduct and consumer risks, including targeting of vulnerable population(s).

Appendix 2: Findings from other jurisdictions

In developing its recommended approach to strengthening protection of vulnerable populations, FSRA reviewed other regulators’ actions to address issues related to consumer vulnerability. Below are some examples of leading practices, some of which are cited in the Financial Consumer Protection and Ageing Populations (OECD) report:

- United Kingdom – Financial Conduct Authority issued Guidance in February 2021 on Fair Treatment of Vulnerable Consumers that articulates actions that firms should take to understand and respond to vulnerable customers’ needs.

- Canada – Autorite des marches financiers published a guide and quick reference toolkit to support the financial services industry in combatting financial mistreatment of vulnerable consumers.

- Malaysia – Bank Negara Malysia published draft requirements and guidance to promote a culture where financial service providers properly consider and respond to the needs of vulnerable consumers, consistent with fair treatment outcomes.

- Multiple organizations including BaFin (Germany), AFM (Netherlands) and ACPR (France) prioritizing research, supervision, or outreach to older consumers more at risk of harm.

Appendix 3: FSRA’s work to strengthen consumer protection

Following are examples of steps taken by FSRA to promote safety, fairness, and choice for Ontarians in FSRA’s regulated sectors:

- Publishing consumer survey research: FSRA’s 2022–2025 Annual Business Plan committed to strengthening FSRA’s consumer research agenda. Strengthening FSRA’s evidence-base around consumers will support its growth as an outcomes-focused and consumer-centered regulator. FSRA has published several research studies. For more information please visit: FSRA Consumer Research

- Take All Comers thematic review: FSRA undertook a broad thematic review of Ontario’s Take All Comers requirement in the auto insurance sector, as it became aware of certain business practices being used which appeared to contravene the requirement. Read FSRA’s thematic review to learn how FSRA addressed Take-All-Comers non-compliance to better protect consumers.

- Unfair or Deceptive Acts or Practices (UDAP) Rule: The UDAP Rule took effect on April 1, 2022, and was amended effective June 1, 2023. The rule strengthens the supervision of insurance industry conduct and enhances consumer protection by clearly defining outcomes that are unfair or otherwise harmful to consumers. For more information please see: Unfair or Deceptive Act or Practices Rule

- Life and Health Insurance MGA Reviews: Between December 2021 and June 2022, FSRA led and coordinated the joint CCIR cooperative review of individual Life and Health (L&H) insurance business of three Managing General Agencies (MGAs), to ensure consumers are treated fairly. The review identified potential market conduct and consumer risks. For more information please see: CCIR cooperative MGA-focused thematic review

- Code of Conduct for the Mortgage Brokering sector: FSRA adopted the Mortgage Broker Regulators’ Council of Canada’s (MBRCC) National Code of Conduct for the Sector into its supervision framework, to enhance the protection of consumers who work with mortgage professionals in Ontario. The Code outlines key existing requirements that are the most important in meeting consumers’ expectations. For more information, please visit: Code of Conduct for the Mortgage Brokering sector

- Pension Awareness Day and other consumer education campaigns: Each year in February, through FSRA’s Pension Awareness Day, it will raise awareness amongst Ontarians about how participating in the pension plan can be beneficial to them. As part of its first annual Pension Awareness Day in February 2023, FSRA provided pension education online, tips on ways to maximize a pension plan, an explanation about common misconceptions, and advice from pension experts in a new podcast series. FSRA has executed a number of consumer education campaigns to help empower consumers to make informed financial decisions.

[1] The Financial Consumer Agency of Canada (FCAC) in their Financial Literacy Strategy describes financial resilience as the ability to adapt or persevere through both predictable and unpredictable financial choices, difficulties, and shocks in life.

[2] Queens University defines equity deserving groups as communities that experience significant collective barriers in participating in society. This could include attitudinal, historic, social and environmental barriers based on age, ethnicity, disability, economic status, gender, nationality, race, sexual orientation and transgender status, etc.

[3] FCAC’s COVID-19 Financial Well-being Survey, found that hardships have increased more for Indigenous peoples and women, due to the disproportionate financial impact of the pandemic on these groups; for e.g., the survey found that indigenous peoples were 1.4 times more likely, and women were 1.1 times more likely, to experience negative outcomes.

[4] Please see Consolidated Observation Report for further context