Executive summary

Consumers looking to obtain or invest in a mortgage are now facing greater risks due to significant uncertainty in the current economy. This increases the need for regulators to supervise the mortgage brokering sector, especially with respect to how they service the more financially vulnerable clients. Supervision ensures that mortgage agents or brokers protect their clients and always have their interests in mind.

Many consumers rely on a mortgage agent or broker to help them finance and re-finance a home. In some cases, mortgage professionals also provide advice to investors on mortgage investments. However, the value of an agent or broker – particularly in an uncertain market – is the expertise, guidance and advice they provide. These competencies ensure they understand and craft the right mortgage solution for their clients’ current situation that takes into account uncertainty in the future. Skilled and knowledgeable mortgage professionals are also empowered to help clients navigate the stressful process of obtaining and renewing a mortgage.

In Ontario, the mortgage brokering sector continues to grow since the beginning of the COVID-19 pandemic. As of June 14, 2022, FSRA licensed 2,935 brokers and 15,196 agents, compared to 2,833 brokers and 12,277 agents on June 30, 2019. This represents close to 20 percent growth from 2019. The number of brokerage firms remained relatively stable at about 1,250.

How does FSRA protect mortgage brokering consumers?

FSRA supervises and examines mortgage brokerages, administrators, brokers and agents’ business practices to ensure they:

- provide products and services that are suitable for each client

- provide services in a transparent and effective manner

- comply with all applicable legal and regulatory requirements

Consumers should expect their broker or agent to provide solutions while keeping their interests top of mind. They should not hesitate to ask questions if there is something they don’t understand.

FSRA’s 2021-2022 supervision focus and findings

FSRA focused its 2021-2022 supervision activities on private mortgage brokering and administration of non-qualified syndicated mortgage investments (NQSMIs). Last year’s examinations found that brokers and agents did not follow regulatory requirements and best practices in private mortgage brokering. For example, in 22 of 39 transactions reviewed, brokers or agents did not document their suitability assessment of the recommended mortgages. Moreover, mortgage administrators were not providing adequate and timely information to investors about their mortgage investments.

2022-2023 areas of supervision focus

FSRA is concerned by its findings that brokers and agents were not following requirements and best practices in private mortgage brokering. In a market where the potential for consumers to turn to private lending remains high because of interest rate hikes and inflation, FSRA determined that private mortgage brokering must remain a supervision focus for 2022-2023.

FSRA also observed two more recent trends and developments that could increase consumer protection risks in this sector this year, such as:

- an increase in the number of new licensed brokers and agents in this sector who may have less experience, especially providing advice and guidance to clients in a rising rates and inflationary environment.

- higher-than-average financial vulnerability of consumers in the mortgage brokering sector.

To address these consumer risk areas, FSRA identified the following supervision areas of focus for 2022-23:

- continued focus on ensuring private mortgages are suitable for and are understood by borrowers.

- review conduct culture, compliance structure and principal broker’s supervision in large brokerages.

- conduct supervisory research and compliance reviews in scenarios where financially vulnerable consumers may be more prone to misconduct or abuse.

As per the new NQSMI regime implemented in July 2021, FSRA will also examine how mortgage brokerages who broker NQSMI transactions are ensuring that they only deal with permitted clients unless they have the appropriate securities registration.

What this means for industry and consumers

Mortgage brokerages, principal brokers, brokers, agents and administrators should review this plan and other FSRA publications.

FSRA reminds brokerages of their obligations to ensure that any mortgages or mortgage investments that they present to consumers are suitable based on their needs and circumstances. Brokers and agents must also provide adequate disclosure. This is to ensure consumers understand the risks and implications of a recommended mortgage, especially in the current uncertain market.

We would also like to remind principal brokers of their obligations to take reasonable steps to ensure their brokerage, brokers and agents comply with regulatory requirements. This includes establishing, updating, and effectively implementing policies and procedures.

Through supervision, FSRA aims to protect consumers and achieve the following outcomes:

- mortgage recommendations provided by mortgage brokers and agents are suitable based on their client’s specific needs and circumstances

- adequate disclosure is provided to mortgage consumers at the point of a transaction.

2021-2022 year in review

What did we do?

In the spring of 2021, when we developed our supervision focus, Canada (and the rest of the world) entered its second year of the COVID-19 pandemic.

At the time, Canadian Mortgage and Housing Corporation (CMHC) forecasted that home sales and price growth would continue to be elevated from pre-COVID levels, although moderated from 2020 levels, due to:

- continued demand and supply imbalance

- economic and employment recovery from losses incurred during the pandemic

- governments starting to lift pandemic restrictions

The Bank of Canada (the Bank) in its 2021 Financial System Review noted signs that people may be buying homes because they expect that prices would continue to increase. This has raised people’s tolerance for higher mortgage balances relative to the value of the house and their income, which has contributed to rising leverage and larger mortgages leading to higher household indebtedness. The Bank also noted that the quality of mortgages issued by Canadian banks based on loan-to-value ratio declined in 2020,1 and new mortgage debts issued by Canadian banks from 2019 to 2020 came primarily from borrowers with higher loan-to income ratios and higher loan-to-value ratios.2

To address banks’ potential increase of financial risk from higher exposure to mortgages and lower quality mortgages, the Office of the Superintendent of Financial Institutions (OSFI) revised, effective June 1, 2021, the minimum qualifying rate for uninsured mortgages (i.e., residential mortgages with a down payment of 20 percent or more) to be the greater of the mortgage contract rate plus two percent or 5.25 percent.3 The impact to borrowers is a larger down payment or a reduction in the mortgage loan amount between 2 percent and 4 percent.4

With the further constraint on Canadian banks’ residential mortgage lending, coupled with Canadians’ demand on housing and mortgage financing, FSRA expected a higher proportion of borrowers to continue to rely on alternative lenders to finance their home purchases. Many of these borrowers depended on advice from mortgage professionals on mortgage options, suitability and affordability.

Although the residential housing market had been strong despite the pandemic, other real estate segments, including the commercial market, office, retail and hospitality, continued to be negatively impacted by COVID.5Sophisticated investors with experience in real estate and mortgages recognized the differences and outlook, and were expected to adapt their investment strategies accordingly. Less sophisticated investors were chasing yields but might not have fully understood the risk of some of these asset classes. Many investors might also not have understood the differences between real estate investments and mortgage investments. They might have been attracted to the yield of mortgages funding non-stabilized real estate (like construction) without fully appreciating the corresponding risks. Mortgage brokerages who arrange mortgage investments and mortgage administrators who manage mortgage investments for less sophisticated investors have taken on a greater advisory role in this environment.

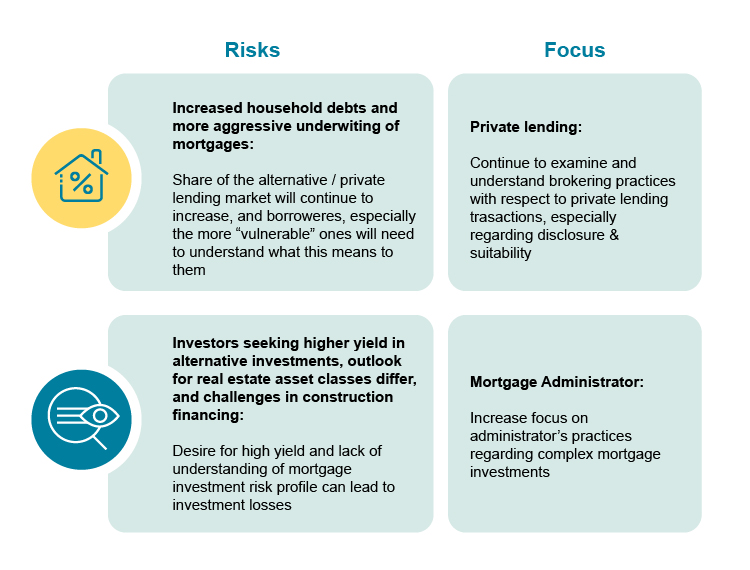

Based on the potential risks to mortgage borrowers and mortgage investors, we identified the following supervision focus for 2021-2022:

What did we find and what did we learn?

Private Mortgage Brokering

In the first round of our review of private mortgage brokering, we examined a sample of 39 private mortgage transactions from a number of brokerages that engaged in such activity. We noted the following practices that are not consistent with the consumer protection intent of relevant regulatory requirements:

- in 22 of the 39 mortgage transactions reviewed, mortgage brokers or agents did not document their suitability assessment of the recommended mortgages to demonstrate how the recommendations met the needs of the borrowers

- many brokerages employ the use of a “know your lender/investor” form to gather this information from prospective private lenders during the vetting/onboarding process, but they do not always document or update the lender’s financial needs and circumstances to support their suitability assessments

- in 10 of 39 transactions, commitment letters presented to borrowers for signing did not identify or confirm the private lender, which raised questions about how the brokers or agents were meeting the requirements to disclose to the borrower the nature of the relationship between the brokerage and the lender and any actual or potential conflict of interest.

We made similar findings in subsequent rounds of our examinations. See Consumer protection concerns identified in private mortgage examinations for more details.

Administration of NQSMIs

Last year, we examined practices of mortgage brokerages and mortgage administrations at the time of mortgage renewal or extension with respect to non-qualified syndicated mortgage investments (NQSMIs) that fund construction or development projects, whose performance was the most affected by the pandemic. We were particularly interested in the following:

- the adequacy of mortgage brokerages’ disclosures on material risks and conflicts of interest at the time of mortgage renewal and at the initial point of sale

- the adequacy of mortgage administrators’ internal processes and practices in staying informed about a NQSMI’s performance, providing timely notification to investors about material changes, and handling of mortgage funds

We noted the following issues that increased the risks of investors not receiving adequate nor timely information to make appropriate investment decisions:

- Mortgage brokerages:

- inaccurate or insufficient disclosures to investors of conflicts of interest and material risks

- incorrect use of appraised value in loan-to-value calculation for investors

- Mortgage administrators:

- untimely or insufficient notification to investors about circumstances that could materially impact the performance of mortgage investments

- insufficient disclosure to investors of conflicts of interest

- inadequate or non-compliant policies and procedures or mortgage administration agreements

Additional details can be found in Legacy non-qualified syndicated mortgage investments (NQSMIs) review and Improved disclosures needed for legacy NQSMIs.

Current market environment and trends

As a conduct regulator for the mortgage brokering sector in Ontario, FSRA’s mandate includes promoting high standards of business conduct. Licensees’ conduct and ability to service their clients can be influenced by external factors, such as the economy under which they operate and the consumers they deal with. The adequacy of their conduct can also be the direct result of their competency, experience and integrity. As a result, FSRA determines its supervision focus based on the market environment, consumer’s characteristics and sentiment towards the sector, and the characteristics and compliance history of the sector.

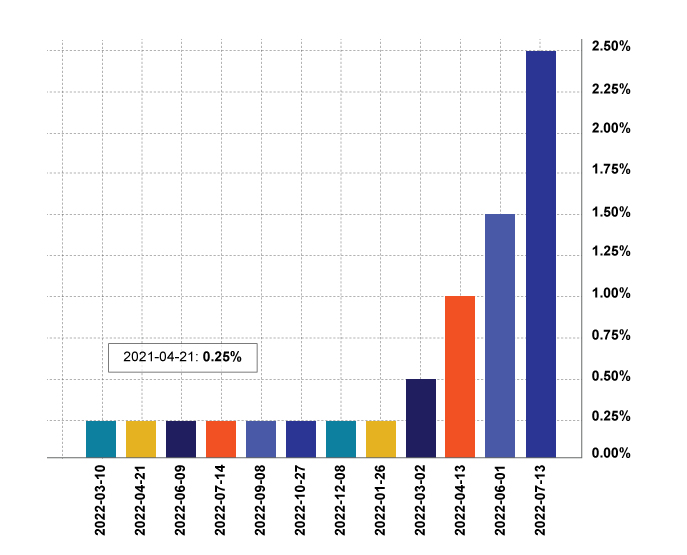

Rising interest rate, inflation and home price correction impact housing affordability for homebuyers

Canada is experiencing the fastest rate hike cycle since the 1990s.6 On July 13, 2022, the Bank raised its policy interest rate by 100 basis points to 2.50 per cent.7 This aligns with its position that interest rates will need to rise further with inflation persisting above target.8

Policy rate changes by the Bank will result in interest rates increasing at most lenders. This will impact borrowers with mortgage rates that fluctuate based on the prime rate (adjustable rate mortgages and variable rate mortgages). The immediate impact will be on borrowers whose periodic payments are not fixed but vary based on current interest rates. Borrowers with fixed periodic payments, on the other hand, will pay more interest and less principal even though their regular fixed payments will not change. Many borrowers, especially those whose mortgages are close to renewal will need to navigate the uncertainty in the market when considering mortgage options going forward.

The Bank conducted a simulation of the potential impact of higher interest rates on future mortgage payments. The simulation focuses on 1.4 million variable- and fixed-rate mortgages with a five-year term taken out at federally regulated financial institutions over 2020-2021. It looks at impact on monthly payments should these mortgages be renewed at median rates of 4.4 percent and 4.5 percent, respectively, in 2025-2026. The median increase in monthly mortgage payment upon renewal would be $420 or 30 percent.9

In addition to interest rate change, the cost of living for Canadians continues to rise as reflected by a 8.1 percent year-over-year increase in the consumer price index in June 2022.10 This represented the yearly change since 1983.11

Institutional lenders, like banks, credit unions and finance companies, are also paying close attention to inflation and how the Bank will apply monetary policy to address it. In the Bank’s latest Financial System Survey that solicited the opinions of senior experts in risk management, high inflation and low economic growth were the most cited domestic macroeconomic risks, and some noted they plan to manage these risks by adjusting their exposure to assets. Respondents were also asked about their views on monetary policy normalization, and they were concerned about the impacts that unexpected normalization could have on their organizations. Respondents from banks noted that following a faster-than-expected normalization or a slower-than-expected normalization, they would either reduce their risk exposure or be more selective when increasing their exposure to risk assets.

With cost of living rising and the interest rate expected to continue to rise, Canadians will be less financially resilient especially when household indebtedness intensified in the last few years. The Bank noted that since mid-2020, some households have taken on significantly more mortgage debt, which is reflected in an increase in the share of new mortgages with high loan-to-income ratios.12 The Bank noted that a large decline in household income and house prices would make it difficult for households to service their debt and could reduce their net worth and access to credit.13

In its latest Financial System Review published in June 2022, the Bank renewed its concerns with elevated levels of household debt and high house prices. It also notes that the share of highly indebted households has risen. These households are more vulnerable to a decline in income and will face more financial strain when they renew their mortgages at higher rates.14 Should monetary policy normalization cause traditional lenders, like banks, to be more selective in their lending, more consumers in challenging situations would have difficulty in accessing or maintaining mortgages to finance their homes. A recent Manulife Bank debt survey found that close to one in four homeowners say if interest rates were to increase further they would be forced to sell their home.15

Decline in household disposable income has materialized with current inflation and the Bank expects inflation to move higher in the near term before beginning to ease.16 Future house prices, however, remain uncertain. CMHC, in its Spring 2022 edition of the Housing Market Outlook, indicates that it expects growth in prices, sales levels and housing starts to moderate but remain elevated in 2022. The growth in prices will likely continue to be led by markets with low listings including Toronto. Its outlook is subject to risks, including stronger inflation pressures and interest rate increases and resurgent infection rates and restrictions due to COVID.

Subsequent to the CMHC’s publication, latest statistics released by the Canadian Real Estate Association (CREA) in June 2022 shows that national home sales dropped by 8.6 percent on a month-over-month basis in May building on a larger drop recorded in April, and home prices based on the MLS Home Price Index adjusted down slightly from previous month but still up from the year before.17 CREA noted that most of the monthly declines were seen in markets in Ontario, and the majority of Ontario markets saw prices dip from April to May.18

Consumer characteristics and experience with the mortgage brokering sector

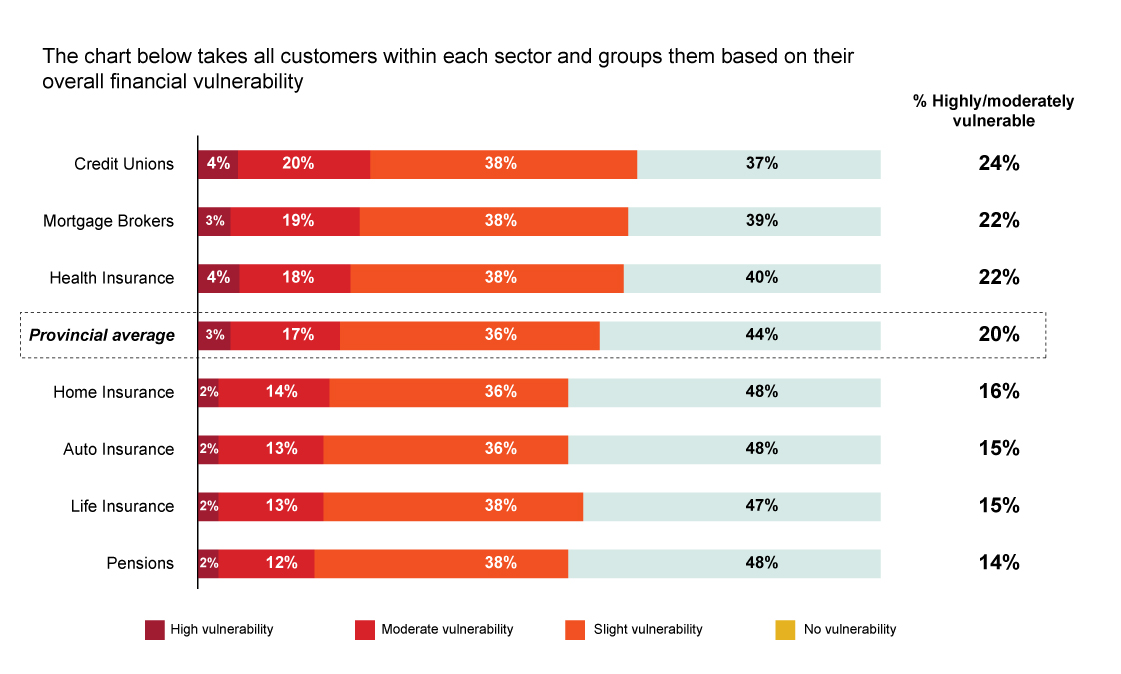

In the spring of 2022, FSRA engaged an external research firm to conduct an online survey of consumers to better understand consumer attitudes, behaviours, awareness/knowledge and characteristics. The survey also provides a baseline for ongoing data gathering to monitor outcomes and track trends over time. The survey took place in March 2022 and 4,000 adults, 18 years or older, from Ontario participated.

Forty percent of homeowners said they have worked with a mortgage broker in the past five years. The most common reason a respondent chose to use a broker instead of directly with a lender was because of better or lower rates (at 31 percent).

The survey also gathered data about financial vulnerability of respondents. Markers of financial vulnerability are organized into the categories of:

- health

- financial capability

- life events (e.g. providing financial support to others)

- resilience (e.g. indebtedness, income level and variability)

These markers are consistent with what other financial regulators use, as well as vulnerability data FSRA collected in the 2021 Annual Information Return (AIR) for mortgage brokerages. Of the sectors regulated by FSRA, the survey found that consumers in the mortgage brokering sector are more vulnerable than average, with 22 percent considered highly or moderately vulnerable compared to the provincial average of 20 percent.19 This finding is not unexpected because these consumers are more likely to need to turn to mortgage brokers for advice in order to access credit. This finding, however, should not be interpreted as the sector only dealing with vulnerable consumers.

The survey found that vulnerability generally impacts everything for consumers, from confidence to trust, from access to service to how consumers navigate each financial sector surveyed. Of all the categories of vulnerability, capability is consistently important and most correlated to consumer’s experience and attitude.

In the mortgage brokering sector, the highly vulnerable consumers are likelier to encounter poor service, unexpected costs (e.g. higher interest rate) or unexpected changes to terms and conditions. The survey findings about vulnerable consumers in the mortgage brokering sector indicate that foundational obligations under the Mortgage Brokerages, Lenders and Administrators Act (MBLAA) and corresponding principles under the sector’s Code of Conduct for the Mortgage Brokering Sector are critical in protecting consumers especially in an uncertain market environment:

- competence – maintaining the skills, knowledge and aptitudes necessary to understand the product and the market

- suitability – understanding a customer’s specific needs and circumstances and arranging a mortgage or mortgage investment based on those needs and circumstances

- disclosure – providing complete, accurate and objective disclosure about a recommendation and ensuring a customer’s understanding

In addition to the survey findings, FSRA noted that vulnerable consumers, in particular seniors, appeared to be more frequent victims of fraud. For example, door-to-door scams with respect to home renovations and home service/equipment contracts have led to increased mortgages and home liens for some homeowners (without the involvement of a licensed mortgage broker or agent).

The survey also found that, customers encountered issues with mortgage brokers far more often than any other of FSRA’s regulated sectors. Thirty-one percent indicated that they experienced at least one issue in the past five years, compared to 22 percent of customers of the next sector that had the most issues. A recent report by the Globe and Mail notes that spike in complaints is normal for the investment industry when the markets drop, particularly in areas such as investment suitability and a perceived lack of communication.20 Interest rate increase and inflation have introduced a lot of uncertainty in the market. FSRA therefore anticipates that a similar complaint trend will be noted for other financial services sectors including the mortgage brokering sector.

When it comes to mortgage investments, respondents who are considered highly vulnerable are twice as likely to have invested in mortgage investments in the past five years. Forty-five percent of all respondents believe that mortgage investment is another way of investing in the real estate.

Characteristics of the mortgage brokering sector

Mortgage Brokerages, Brokers and Agents

The number of licensed brokers and agents in Ontario continues to grow since the beginning of the pandemic. As of June 14, 2022, FSRA has licensed 2,935 mortgage brokers and 15,196 mortgage agents, compared to 2,833 brokers and 12,277 agents on June 30, 2019, representing a close to 20 percent growth from 2019. The number of brokerage firms remained relatively stable at about 1,250. In addition, based on the 2021 AIR received, 31.2 percent of licensed individuals were part-time in 2021, whereas only 26.8 percent of licensed individuals were part-time in 2020.

This means that each brokerage and its principal broker is now responsible for more licensed individuals and less experienced and less dedicated individuals.

Principal brokers are obligated to ensure compliance of their brokerage, brokers and agents.21 All licensed brokerages are required to appoint a principal broker who is a licensed broker in good standing.22 FSRA would immediately suspend the licence of a mortgage brokerage that does not have a valid principal broker, or revoke the brokerage’s licence if the situation is not rectified. Last year, FSRA examined 108 brokerages that did not have a principal broker. Of these, the licenses of 30 brokerages were or will be revoked, 37 have or will surrender their licenses, and 11 have other enforcement actions underway. The remainder have rectified or are in the process of rectifying the non-compliance.

Mortgage brokerages varied significantly by size, both by value of mortgages brokered and number of licensees employed. The largest brokerage brokered $10 billion of mortgages in 2021, whereas a number of brokerages have no volume in 2021. The largest brokerage employed over 1,000 licensed individuals at the end of 2021, whereas many only have one licensed individual.

With the hot housing market and increased household debts, the value of mortgages brokered by licensed brokerages have increased. Based on initial submissions of mortgage brokerage AIRs, the aggregate value of mortgages brokered increased by 15.7 percent to $199 billion in 2021 from $172 billion in 2020, although the number of mortgages brokered declined by 10.8 percent to 337,320 in 2021 from 378,308 in 2020.

Initial AIR submissions also indicate that the value and number of mortgages from traditional lenders, like banks and credit unions, have shown steady increase in the last five years (with a temporary decline for credit unions in 2019 and 2020, probably due to the pandemic):

- banks: value of mortgages funded in 2021 was $83 billion compared to $50 billion in 2017; number of mortgages funded in 2021 was 151,000 compared to 125,000 in 2017

- credit unions: value of mortgages funded in 2021 was $6.85 billion compared to $5.06 billion in 2017; number of mortgages funded in 2021 was 11,000 compared to 10,000 in 2017

Overall, the value and number of mortgages funded by alternative lenders, which include mortgage finance companies (MFCs), mortgage investment corporations (MICs), other mortgage investment entities and private lenders, have increased. MFCs and MICs have shown significant increase in both volume and value since FSRA collected data:

- Mortgage finance companies: value of mortgages funded increased from $15.8 billion in 2019 to $29.9 billion in 2021 (by 89.75 percent), and the number of mortgages funded increased from 42,000 in 2019 to 66,000 in 2021 (55.30 percent);

- MICs: value of mortgages funded increased from $4.2 billion in 2017 to $8.1 billion in 2021 (by 94.8 percent), and the number of mortgages funded increased from 8,000 in 2017 to 15,000 in 2021 (by 92.4 percent).

More mortgage brokerages also appear to be involved in operating a MIC. AIR data from 2019 to 2021 indicate that the number of brokerages whose principal broker, directors or officers holding management roles in a MIC increased by 24 percent from 62 in 2019 to 77 in 2021, and the number of MICs fully managed by a principal broker also increased by 65 percent from 26 in 2019 to 43 in 2021.

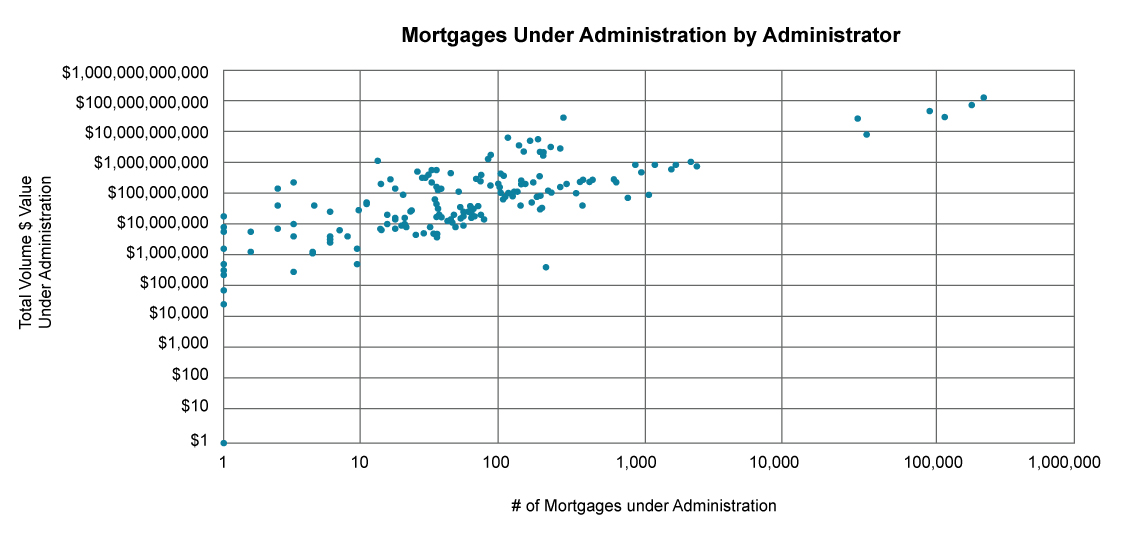

Mortgage Administrators

The number of licensed mortgage administrators has also increased to 240 as of March 31, 2022 from 229 in the previous year. Based on the 2021 AIRs received,23 mortgage administrators administered a total of 826,767 mortgages valuing at $344 billion at the end of the year, compared to 806,815 mortgages valuing at $289.5 billion at the end of 2020, representing an increase of 2.5 percent and 18.9 percent respectively.

Similar to mortgage brokerages, mortgage administrators also vary significantly based on value of mortgages administered from the 2021 AIRs received. Multiple administrators reported no mortgages under administration, whereas the largest administrator reported administering over $100 billion of mortgages.

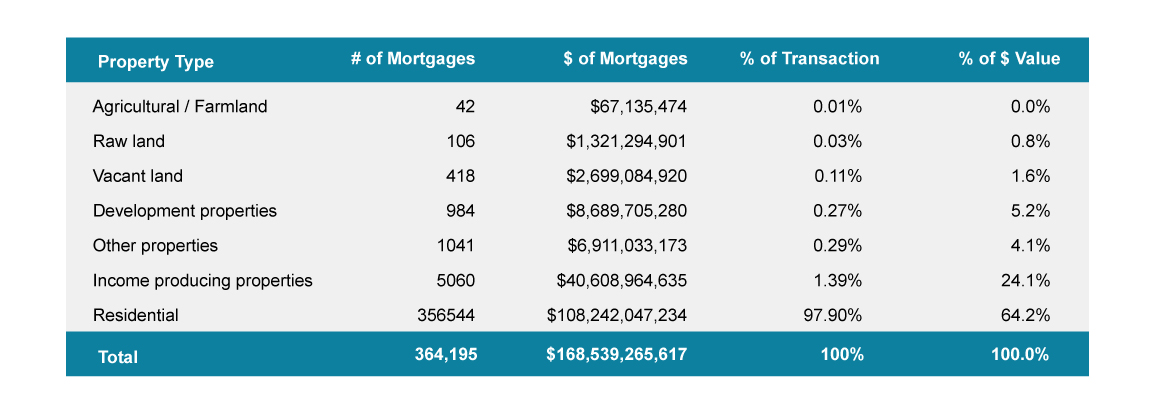

Of the total mortgages under administration in 2021, 364,024 valuing at $168 billion were in Ontario. The first year which FSRA collected data through the AIR about the nature of mortgages administered by the administrators was in 2021. Of the mortgages under administration, only a small percentage, by both volume and value, funds non-stabilized properties (i.e. raw land, vacant land, and development properties) which are inherently riskier than mortgages funding other property types.

FSRA will be releasing its 2021 AIR report later in 2022 with more information.

Other considerations

FSRA also takes into account the following recent changes to the regulatory landscape when considering 2022-2023 supervision focus:

- Implementation of a new licensing class for agents who wish to arrange mortgages for all lenders including private lenders, with enhanced education effective April 1, 2023; and

- Transfer of the oversight of certain NQSMI transactions to the Ontario Securities Commission effective on July 1, 2021, resulting in FSRA overseeing NQSMIs that are sold only to permitted client investors after the transfer date and continuing to oversee the administration of all NQSMIs.

Areas of supervision focus 2021-22

FSRA is of the view that the following increases consumer protection risks to this sector:

- Uncertainty in the environment due to Canada experiencing the fastest interest rate hike cycle since the 1990s24, inflation at its highest point since 198325 and potential correction of housing prices. These factors make it difficult for certain households to service their debts and access credit through traditional financial institutions. Consequently, they may have to rely on private mortgages or multiple mortgages to finance their home.

- a close to 20 percent increase in the number of licensed brokers and agents in this sector since the beginning of the pandemic, many of whom have less experience and may not have lived through an inflationary market

- higher-than-average financial vulnerability of consumers in the mortgage brokering sector, with 22 percent considered highly or moderately vulnerable compared to the provincial average of 20 percent

- vulnerable consumers, in particular seniors, appeared to be more frequent victims of fraud. For example, door-to-door scams with respect to home renovations and home service / equipment contracts have led to increased mortgages and home liens for homeowners.

To address consumer protection risks, achieving the following outcomes continue to be important to FSRA:

- Mortgage recommendations provided by mortgage brokers and agents are suitable based on their client’s specific needs and circumstances; and

- Adequate disclosure is provided to mortgage consumers at the initial point of a transaction and during the term (where applicable).

As a result, FSRA will continue to focus its supervision in 2022-2023 in ensuring borrowers are protected in private mortgage brokering, through:

- adequate know-your-client process

- suitable recommendation

- sufficient disclosure about mortgage features and implications

- clear and fair commitment letters

- adequate consideration of exit strategy to ensure clients can transition back to more traditional financing

- adequate disclosure and management of conflicts of interest

In addition, FSRA will also focus its supervision on conduct culture, compliance structure and principal broker’s supervision in large brokerages to ensure that:

- new agents are appropriately hired, trained and overseen,

- all brokers and agents are conducting their activities with integrity and competence while keeping client’s interest in mind, supported by a strong conduct culture within the brokerage, and

- up-to-date policies and procedures, including the Code of Conduct, are effectively implemented.

FSRA will also conduct supervisory research and compliance reviews of the following scenarios where financially vulnerable consumers may be more prone to misconduct or abuse:

1. Arrangement of mortgages for borrowers by brokerages who also manage a mortgage investment corporation (MIC), to assess how the brokerages ensure:

- A mortgage funded by a related MIC is suitable for a borrower, and

- Conflicts of interest from its relationship with its MIC are being disclosed and managed.

2. Brokering of reverse mortgages

In 2021, 174 brokerages reported having arranged reverse mortgages in their AIR filings. This number is an increase from 160 brokerages in 2019 and from 125 in brokerages in 2020. The dollar value of reverse mortgages arranged increased from $243 Million in 2019 to $274 Million in 2021.26 The number of reverse mortgages remained comparable between 2019 and 2021 at 882 and 817 respectively.27

The overall objective of the review is to understand the promotion and sales of reverse mortgages and how suitability is determined, specifically with respect to the following:

- Sales, suitability, and disclosure process from the mortgage brokering perspective.

- Types of lenders that are operating in the market.

- Change in demand for reverse mortgages in Ontario over the last three years (2019, 2020, 2021).

- Borrower demographics taking out reverse mortgages; their motivations and possible repayment strategies for the mortgage.

Lastly, with the new NQSMI regime implemented in July 2021, FSRA will also examine how mortgage brokerages who broker NQSMI transactions are ensuring that they only deal with permitted clients unless they have the appropriate securities registration.

|

|

Key Risks |

Supervision Focus |

|---|---|---|

|

Uncertainty in the environment due to increasing interest rates, inflation and potential correction of housing prices in certain housing markets: difficulty for consumers to service their debts and access financing |

Continue to examine private mortgage brokering to ensure:

|

|

|

Higher number of entrants into this sector with less experience, many of whom might not have lived through an inflationary market: inability to provide competent mortgage advice to consumers |

Examine conduct culture, compliance structure and principal broker’s supervision in large brokerages to ensure that:

|

|

|

Higher financial vulnerability of consumers in the mortgage brokering sector: they may be more exposed to misconduct or abuse |

Arrangement of mortgages for borrowers by brokerages who also manage a MIC, to assess:

|

Consumer education

FSRA wants to help consumers understand the financial products and services that we regulate. In early 2023, FSRA will deliver consumer education with respect to private mortgages, as we anticipate more consumers may need to consider such mortgage options when they enter the housing market or when they renew their current mortgages.

1 Chart 4 of Bank of Canada’s 2021 Financial System Review.

2 Chart 5 of Bank of Canada’s 2021 Financial System Review.

3 May 20, 2021, OSFI’s news release Amendments to the minimum qualifying rate for uninsured mortgages.

4 May 21, 2021, OSFI’s Consultation on the Minimum Qualifying Rate for Uninsured Mortgages – Frequently Asked Questions.

5 CMHC, Housing Market Outlook, Spring 2021, and Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

6 June 1, 2022 (updated June 2, 2022), Globe and Mail, Variable-rate mortgage borrowers enduring fastest rate hikes since 1990s.

7 July 13, 2022, Bank of Canada, press release Bank of Canada increases policy interest rate by 100 basis points, continues quantitative tightening.

8 June 1, 2022, Bank of Canada, press release Bank of Canada increases policy interest rate by 50 basis points, continues quantitative tightening.

9 Bank of Canada, Financial System Review – 2022, Box 1.

10 July 20, 2022, Statistics Canada, Consumer Price Index, June 2022.

11 ibid.

12 Bank of Canada, Financial System Review – 2021.

13 Bank of Canada, Financial System Review – 2021, Figure 1.

14 Bank of Canada, Financial System Review – 2022.

15 June 13, 2022, Manulife Financial Corporation, Buyer’s remorse?

16 June 1, 2022, Bank of Canada, press release Bank of Canada increases policy interest rate by 50 basis points, continues quantitative tightening.

17 June 15, 2022, Canadian Real Estate Association, press release Canadian home sales slow again in May.

18 Ibid.

19 Respondents are considered highly or moderately vulnerable if they meet at least 1 marker in each category of vulnerability and 4 to 6 markers across all four categories of vulnerability.

20 June 2, 2022, Globe and Mail, How the investment industry can prepare for a risk in client complaints amid the market downturn.

21 O. Reg. 410/07: Principal Brokers: Eligibility, Powers and Duties

22 S. 7(6) of MBLAA.

23 For 2021 AIRs received up to end of May 2022.

24 June 1, 2022 (updated June 2, 2022), Globe and Mail, Variable-rate mortgage borrowers enduring fastest rate hikes since 1990s.

25 June 22, 2022 CBC News, Canada’s inflation rate now at 7.7% - its highest point since 1983.

26 There was a noticeable dip in dollar value in 2020 to $158 Million as result of the Covid-19 pandemic and temporary a drop in property values.

27 The number of reverse mortgages reported in 2020 was 510, which was also lower than 2019 similar to the value of the mortgages.