Approach

No. GR0010APP Active

Purpose

This Guidance on the Test and Learn Environments (TLEs) for Financial Services Innovation outlines the Financial Services Regulatory Authority of Ontario (FSRA) ’s general approach, guided by FSRA’s Innovation Framework, to using different types of TLEs to validate and assess novel non-capital market financial services products, services, or business models in the following FSRA’s regulated sectors (for greater certainty, in this Guidance, all non-specifically defined ‘regulated financial services sectors’ mean the following list of financial services sectors). All TLE testing will be geared toward accommodating responsible innovation in Ontario’s non-capital market financial services sectors (as defined below):

- Property and Casualty Insurance

- Life and Health Insurance

- Credit Unions and Caisses Populaires

- Loan and Trust

- Mortgage Brokers

- Health Service Providers as they relate to Auto Insurance

- Financial Planners and Advisors

Scope

Throughout this Guidance, FSRA is describing a general test and learn approach that applies to an entity or person licensed in a regulated financial services sector, or an entity or person which is not licensed with FSRA but operating in a FSRA regulated financial services sector.

FSRA will establish specific TLEs with more detailed configurations for specific sectors or activities, where appropriate and subject to FSRA’s regulatory authority. Such specific TLEs will be defined in appendices to this Guidance. S. 15.1(1) of the Insurance Act enables the CEO of FSRA to issue exemption orders in specified areas on the application of a person or entity if, in the CEO’s opinion, it would not be prejudicial to the public interest. In light of this, the first specific TLE will exclusively focus on the automobile insurance sector leveraging such exemptive authorities. For more information, see Appendix 2 – Guide to Applications for Auto Insurance Exemptive Authority TLE.

Rationale and background

FSRA is mandated in accordance with its statutory objects to, amongst other things, foster strong, sustainable, competitive, and innovative financial services sectors, promote high standards of business conduct, and protect the rights and interests of the consumers. (FSRA Act, 2016). The pursuit of innovative new products, services, or business models often requires that innovators pursue a ‘test and learn’ approach, which permits an opportunity to assess the viability of the new product, service or business model while ensuring that it provides a sustainable innovation while not creating undesirable outcomes for consumers.

To that end, FSRA has developed this Guidance as a tool to facilitate innovation in alignment with the common ‘test and learn’ approach as it supports Ontario’s continued development as an environment conducive to innovation through TLEs’ adaptive regulatory scheme while protecting Ontario’s consumers. The TLEs established by this Guidance will act as testing environments for validating the commercial viability and regulatory implications to innovative products, services, or business models while building appropriate and adaptive regulatory protections prior to deployment in the open market.

The development and operation of the TLEs have been and will be guided by a commitment by FSRA to continue to adopt a principles-based approach to administering the regulator schemes under the sector statutes while maintaining a more contextual and outcomes-focused regulatory mindset which reflects FSRA’s statutory objects under the FSRA Act, 2016.

Principles

The creation, deployment, and operation of the TLEs will be guided by the following principles:

- Safe: The testing environment will set parameters that protect consumers and markets from unreasonable risk and avoidable harm.

- Directly beneficial to the public: The opportunity must ultimately benefit the public and consumers through innovation and modernization.

- Adaptable: The testing environment is adaptable to each sector FSRA regulates that has been identified for TLE.

- Deliberate: The testing environment will expand and adjust FSRA’s risk tolerance consciously to encourage innovation and modernization by the applicable sector.

- Fair: The testing environment will ensure that regulatory solutions are made available to incumbents and startups alike.

- Feasible: Innovation opportunities must have a bona fide, ready-to-test solution and will be examined through the most feasible solution in FSRA’s innovation and regulatory toolbox.

- Collaborative: The testing environment will support cross-jurisdictional and cross-sectoral partnerships with provincial, national, and international jurisdictions, industry associations, and innovation hubs.

- Transparent: The testing environment will be based on clearly defined processes that are knowable by Market Participants and the public. FSRA will develop clear reporting methods on innovation allowed and how those innovation opportunities are working.

- Accountable: FSRA will maintain accountability to the public and the sectors by reporting on how it has used its tools to support innovation, where innovation has been successful and not successful and why and where additional innovation or tools may be needed to allow innovation to operate properly in a sector.

Processes and practices

Eligibility

The TLEs are open to all Market Participants that are in good standing with FSRA and other applicable regulators, or who otherwise agree to be subject to FSRA’s jurisdiction, including both incumbents registered within FSRA-regulated financial services sectors and new entrants that plan to conduct FSRA-regulated financial services activities. Market Participants that plan on launching a new product, service, or business model should apply to FSRA as a potential ‘Innovation Opportunity’ for assessment based on TLE principles and criteria for intake and prioritization (i.e. the impact of opportunity, alignment with priorities, and level of difficulty). If an Applicant intends to apply to a specific TLE vehicle intended for a specific sector, that should be indicated in the application.

In this Guidance, the following terms are used to refer to the TLE-eligible or participating entities:

- Market Participants: an entity or person licensed by FSRA to engage in the business of a FSRA regulated financial services sector, or an entity or person which is not licensed by FSRA but is operating in a FSRA regulated financial services sector

- Applicants: Market Participants that are in the process of applying to or have submitted application for a TLE

- TLE (or Test) Participants: Applicants that have been admitted into a TLE

Types of TLEs

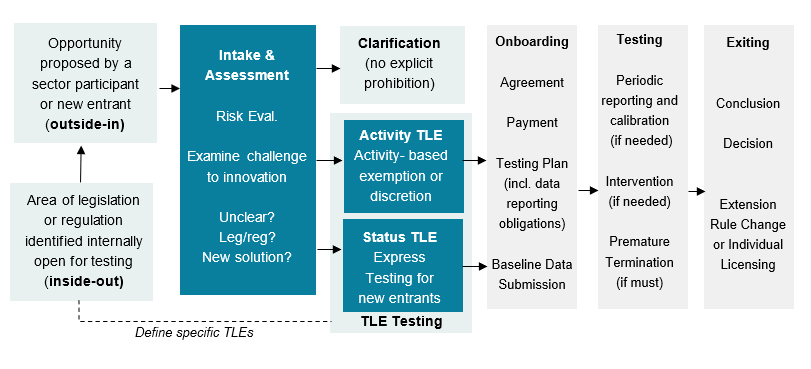

There are broadly two categories of TLEs:

- “Activity TLEs” means a contractually established environment where FSRA is comfortable exercising its exemptive[1] authority or discretion to test otherwise non-permitted business activities under the current regulatory framework through deliberate utilization of available and appropriate regulatory tools on a strictly as-needed basis.

- “Status TLEs” means a contractually established environment where FSRA is comfortable exercising its exemptive authority or discretion to issue time-limited and scope-restricted conditional licensing of a Market Participant to enable controlled market validation of innovative products and services. Status TLEs are designed to ensure regulatory oversight and level the playing field for all market participants’ proposed innovation opportunities to be carried out. Status TLEs will not accept applications intended to bypass the regulatory requirements and standards on knowledge, examination, and professional conduct required of licensees within a regulated sector.

For a Status TLE project that would include testing on matters that would fall under the Activity TLEs, a corresponding Activity TLE test spin-off project will be created to allow the product, service, or business model to be tested following the Activity TLE requirements and post-test learnings applied accordingly.

FSRA’s TLEs are available to all FSRA-regulated financial services sectors as an adaptable yet customizable innovation validation mechanism. Specific TLE vehicles that suit sector-specific objectives and leverage regulatory tools available to the sector must be established individually to ensure the most relevant procedures and safeguards are put in place. FSRA may use exemptive authority pursuant to s. 15.1 of the Insurance Act and, where appropriate, exercise regulatory discretion to facilitate innovation. The use of such tools will be a case-by-case decision by FSRA consistent with the overall statutory objects and not prejudicial to the public interest.

Market Participants should be advised that admission into a TLE does not provide exclusivity for the activity tested nor immunity for the TLE participant and its innovation from competitive barriers imposed by other participants in the market.

TLE process

FSRA will use its innovation process to conduct innovation opportunity intake and assessment and evaluate risks associated with any innovation opportunity proposed by Market Participants.

Once an innovation opportunity is filed, FSRA will process it and notify applicants regarding how it will be handled based on different regulatory considerations and legal issues, risk assessment results, and other relevant factors. Not all innovation opportunities will result in entry to a TLE; a TLE is one of several tools FSRA may use to support an innovation opportunity depending on context and the nature of the opportunity.

Application

An intake form template (see Appendix 1 – Additional Information) will be accessible through a dedicated page on FSRA’s website with application instructions. Market Participants may be directed to the TLE intake form as a part of FSRA’s general innovation process when:

- a novel (non-business as usual) issue is proposed to FSRA for contemplation and approval or review

- this opportunity, though likely to be approved following the current statutory and regulatory requirements, entails intrinsic risks that need to be validated following a more formal process

- under the current regulatory framework, the proposed opportunity is likely to be rejected but has clear merit

Assessment

FSRA will assess all innovation opportunity applications and provide feedback to Applicants on addressing any gaps. Applicants will be given time to reflect on this feedback and improve their final application for assessment, with appropriate deadlines determined by FSRA in the context of the specific TLE.

Applications will be reviewed for completeness and alignment with the TLE principles and criteria for intake and prioritization. If an application is intended for a specific TLE vehicle, the vehicle-specific criteria must also be satisfied.

Risk evaluation

FSRA is committed to supporting responsible innovation in Ontario’s non-capital market financial services sectors, balancing the need to enable sustainable and innovative products, services, and business models with the imperative to ensure that consumers are protected from unnecessary risk.

FSRA’s risk assessment control has been developed as part of the innovation process to achieve this balance. Properly assessing the risk requires meaningful and ongoing dialogue with applicants, with conversations between FSRA and applicants being used to elaborate on potential risks to consumers.

FSRA will work with applicants on regulatory guardrails to manage potential risks to the consumer. This collaborative approach is intended to comprehensively identify and mitigate intrinsic risks, weighing proportionality and risk-benefit alignment for each risk actor, and defining uncertainties in proposed innovation opportunities, ensuring that undesirable consumer outcomes are avoided and appropriate safeguards are developed to protect the Ontario public.

Admission decisions

FSRA will notify successful Applicants and announce TLE admission decisions on the FSRA website.

Following the feedback and revision in the assessment, if an opportunity does not meet the minimum criteria to be processed, the opportunity will be archived. If an opportunity is archived, the Applicant will be notified with reasoning and provided with feedback on improving the application for potential future admission.

Onboarding: Establishing testing parameters and preparing for the test

Key documents

There are three key documents that TLE Participants must abide by while testing their innovation:

- TLE Terms and Conditions, created by FSRA and to which all TLE Participants must agree

- Testing Agreements, setting out the rules that the TLE Participant and FSRA must abide by while participating in the TLE and which all TLE Participants must enter into with FSRA before any testing can commence

- Testing Plans (see Appendix 1 – Additional Information for required information in a Testing Plan), a collaboratively-developed and periodically-recalibrated technical document that stipulates necessary testing parameters, success measurement criteria, data collection and analytics requirements, and consumer protection measures and precautions (see Appendix 1 – Additional Information for the Consumer Protection Control Parameters)

Each TLE will have its own Terms and Conditions; each TLE project is required to have its own Testing Agreement and Testing Plan.

Data collection and analytics

FSRA will collect operational data and algorithms from TLE Participants for analytics and visualization. The binding data reporting obligations and method will be set out in the Testing Plan for each test. TLE Participants must have adequate data collection and processing capabilities to satisfy the reporting requirements. Each test runs independently, i.e. any data or algorithm provided by a TLE Participant to FSRA following the data reporting obligations will only be accessible by the very TLE Participant and FSRA alone and exclusively used for test validation and supervision purposes.

On or before the agreed-upon date, TLE Participants must sign a declaration on data authenticity and no-tampering guarantees and submit the baseline data elements so the test can start on the designated date.

Fee structure

Subject to FSRA’s authority to impose the fee under Part 10 of the FSRA Fee Rule, the following fee approaches will be considered for TLE Participants utilizing the TLEs, depending on the type of TLE utilized and their registration status:

- For projects admitted into Activity TLEs: an application fee that would reflect the consistency and fairness principles in accordance with FSRA Fee Rule’s visions and principles at the point of application.

- For an entity or person licensed to engage in the business of a regulated financial services sector: a quota to use TLEs will be allocated each fiscal year. Any applications after the quota are used up are subject to the application fee.

- For an entity or person which is not licensed with FSRA but is operating in a FSRA regulated financial services sector: any applications (spin-off from Status TLE) are subject to the application fee.

- For projects admitted into Status TLEs:

- Any TLE Participant that does not currently hold the necessary FSRA approval or license to carry out the intended business may be charged a fee to receive a conditional license. The fee amount will be determined by the FSRA resources allocated to address the request, as the benefits of such approvals accrue to the Applicant.

- The business activity will be examined in an Activity TLE and is subject to Activity TLE fees.

Payment

Once determined through the TLE application assessment process, applicable fees will be charged upfront, either at admission or as a prerequisite for further processing.

Testing journey

TLE Participants must follow the agreed-upon data and evidence submission requirements in the Testing Plan. Late submission or failure to report essential data and evidence could trigger varying degrees of intervention actions, up to and including the declaration that the test has ended.

FSRA will analyze reported data and evidence. Based on the trajectory, projection, deviation, or anomalies detected, FSRA will communicate with the TLE Participant about the observations and take appropriate actions.

A plan to implement the corrections and to prevent similar contraventions will need to be developed by the TLE Participant and be submitted to FSRA for approval within a set deadline. The progress of implementing the correction and prevention plan must be regularly reported by the TLE Participant. FSRA may designate an intensive supervision period and require additional reporting. FSRA may also conduct interviews or investigations if such measures are necessary.

Exiting

Premature termination

Either the TLE Participant or FSRA can terminate the test prior to the end of the testing period upon provision of the requisite written notice pursuant to the Testing Agreement (with an exception for FSRA terminating a test without notice because of public interest concerns, e.g. consumer complaints, severe anomalies or contraventions to the testing parameters detected from data analytics).

If a test is terminated, the TLE Participant shall activate the precautions set out in the Testing Plan to migrate affected consumers to a pre-selected alternative product or service or take other necessary remedial or impact minimizing measures. The plan and progress of such actions need to be reported to FSRA.

Mature conclusion

A mature conclusion is when a test concludes following the expiry of the testing period as stipulated in the Testing Plan. A maturely concluded test can lead to the following outcomes:

- Approving for future use: all the critical success metrics in the Testing Plan are met

- For Activity TLE Participants: the otherwise prohibited practice being tested should be allowed to be continued to carry out by the TLE Participant. The test-related regulatory certificate (e.g. an exemption order) should be renewed with:

- a new expiry date (subject to the maximum allowed duration of the relevant regulatory certificate)

- the same conditions (limitations and restrictions)

- appropriate safeguarding measures learned from the test

- In parallel, FSRA will recommend changes to applicable laws or regulations for contemplation.

- For Status TLE Participants: the temporarily granted conditional licensee or registrant status pertaining to the test cannot be carried over or transferred and is now invalid. The product/service being tested through the corresponding Activity TLE spin-off will be treated as an Activity TLE project and if the said business activity can be continued is contingent on the Market Participant pursuing regular licensing itself or an FSRA-approved outcome transferal to another licensee in certain circumstances. If needed, FSRA may recommend changes to applicable laws or regulations for contemplation.

- For Activity TLE Participants: the otherwise prohibited practice being tested should be allowed to be continued to carry out by the TLE Participant. The test-related regulatory certificate (e.g. an exemption order) should be renewed with:

- Not approving for future use: subject to FSRA’s final decision

- For Activity TLE Participants: the previously prohibited practice being tested remains banned with renewed and clarifying safeguard measures proposed, and the test-related regulatory certificate is invalidated.

- For Status TLE Participants: the product/service being tested ceases. Whether or not the entity would seek regular licensing/authorization is not contemplated by the TLE.

Transparency and consumer protection

Transparency

Transparency is an essential component of the TLEs, helping ensure that TLEs are used in a manner that inspires trust in the fairness and consistency of their use. FSRA will develop clear reporting methods and regularly share with a variety of stakeholders on which innovation opportunities have been admitted, how they’re working, and which are approved to a variety of stakeholders, including competitors and consumer advocates, while protecting business secrets and intellectual properties. Please see Appendix 1 – Additional Information for the items FSRA will make public and through what method.

Aggregated market conduct scan

FSRA will conduct proactive and cross-jurisdictional market scans to understand innovative practices and business models now being proposed and contemplated by global financial services regulators to inform future areas of attention and set up reporting channels for industry and the public to report novel market practices impermissible under the current regime and should be validated through the TLEs.

FSRA will work with Market Participants responsible for such unauthorized activities to validate their innovation or modernization through the proper TLE channels.

Mandatory consumer disclosure

TLE Participants must provide necessary disclosure to consumers on the products or services consumers have purchased or received in the TLE. Please see Appendix 1 – Additional Information for the requirements for the mandatory consumer disclosure.

Consumer feedback on TLE test projects

FSRA expects the complaints mechanisms established by TLE Participants to be accessible, fair, timely, transparent, and effective. In addition to the regular complaints process established by TLE Participants, consumers will have the opportunity to directly contact FSRA to provide feedback.

Intervention steps

FSRA would detect anomalies, contraventions, and unintended situations through regularly reported data and evidence tailored to each test, as well as through TLE consumer complaints filed through FSRA. Given the importance of data being regularly reported, any late reporting or failure to report required information as per the Testing Plan would be deemed an anomaly.

If an anomaly is detected, FSRA will contact the TLE Participant and provide an opportunity for it to explain the anomaly. If an anomaly is caused by a contravention of any parameters in the Testing Plan, FSRA will determine the necessary course of action, including any required potential correction and remediation actions.

A plan to implement the corrections and to prevent similar contraventions will need to be developed by the TLE Participant and be submitted to FSRA for approval within a set deadline. The progress of implementing the correction and prevention plan must be regularly reported by the TLE Participant. FSRA may designate an intensive supervision period and require additional reporting. FSRA may also conduct interviews or investigations as necessary.

Continued monitoring for TLE projects after decision

Considering issues may arise that were not surfaced during the TLE and the newly summarized and announced safeguards would need to be validated, out of an abundance of caution FSRA may continue to require TLE Participants to report data and reports with reasonable frequency to FSRA for supervision and intervention purposes.

Effective date and future review

This Guidance will take effect on January 1st, 2022. This Guidance is published following the test and learn approach: FSRA will continually improve and ameliorate our TLEs based on data and feedback from our initial cohorts, with a dedicated review at least once a year.

About this guidance

This Guidance is an Approach. Approach Guidance describes FSRA’s internal principles, processes and practices for supervisory action and application of Chief Executive Officer discretion. Approach Guidance may refer to compliance obligations but does not in and of itself create a compliance obligation. Visit FSRA’s Guidance Framework to learn more.

Appendices and reference

Appendices

- Appendix 1 – Technical Information

- Appendix 2 – Guide to Applications for Auto Insurance Exemptive Authority TLE

- Appendix 3 – Guide to TLE applications requesting FSRA exercise regulatory discretion

Reference

Appendix 1 – Technical Information

Purpose of Appendix

Appendix 1 (the Appendix) to the TLE Guidance (the Guidance) outlines technical information, including detailed operational requirements and processing policies complementary to the general approach described in the Guidance.

Scope

The Appendix applies to any innovation opportunity proposed to FSRA for contemplation by an Applicant.

Required information upon intake

Before submitting a TLE application, an Applicant intending to propose an innovation opportunity to FSRA must use the application form designated in relevant Guidance appendices.

For the purpose of facilitating innovation efficiently, the innovation office may arrange a single introductory meeting for each intended Application to assist the Applicant in better preparing their Application. If an Applicant wishes to meet with the Innovation Office before submitting their Application, they must provide an opportunity summary that includes all the information specified in Table 1.

Table 1: Required information in an opportunity summary

| # | Item | Description |

|---|---|---|

| 1 | Opportunity | Name the innovation opportunity that is being proposed. |

| 2 | Organization | Provide the legal entity name and trade name (if any) of the organization proposing the innovation opportunity. |

| 3 | Sector | Identify which FSRA-regulated sector(s) the opportunity falls under |

| 4 | Licensing | Indicate whether the organization is licensed with FSRA. Applicants not licensed with FSRA must go through the Status TLE. |

| 5 | Opportunity Statement | Please provide the following:

|

| 6 | Legal Analysis | If applicable, provide a legal opinion that contains the following:

|

| 7 | Target Consumer Segment(s) | Please specify any consumer segments that may be impacted by the test. |

| 8 | Operational Mechanisms | Please explain:

|

| 9 | Pricing Plan & Rationale (if applicable) | Please describe the planned occurrence, amount, and payment method when charging a consumer or client with supporting rationales justifying proportionality and necessity. |

| 10 | Contacts | Business contact information of the project owner and a legal counsel must be provided. |

Required information upon onboarding (testing plans)

A Testing Plan is comprised of the two components below. The Testing Plan may be subject to periodic recalibrations, as agreed upon by FSRA and the Applicant.

- Part A: Test Specifications

Part A elaborates on how an Applicant foresees the test being conducted. - Part B: Compliance Requirements

In addition to the Testing Agreement, Part B may capture what supervisory measures FSRA plans to take and what additional compliance requirements (e.g. consumer protection safeguards) FSRA intends to impose.

An applicant should refer to the information outlined in Table 2 when preparing for Part A of the Testing Plan before proposing it to FSRA for approval.

Table 2: Required information in part A of a testing plan

| Category | Item |

Outline |

|---|---|---|

| Basics | Digest |

|

| Timeline |

|

|

| Merits |

|

|

| Risks |

|

|

| Validation[2] | Hypotheses |

|

| Data/Evidence |

|

|

| Success |

|

|

| Precautions | Alternative Offering |

|

| Consumer Disclosure |

|

|

| Emergency |

|

|

| Special Requests |

|

Consumer protection safeguards

The below two consumer protection safeguards are mandatory for every TLE test. Both mandated practices must be satisfied before a TLE test can commence.

- Alternative offering or arrangement for impacted consumers (Item o and/or q)

- Mandatory consumer disclosure (Item p)

With regards to mandatory consumer disclosure, an Applicant can design and deliver the disclosure in ways that are appropriate to their business context as long as the following guidelines are followed:

- The disclosure must be provided alongside the product or service agreement as an information sheet at the point of sale (or equivalent). The information sheet must contain essential information in a ‘one-pager’ that’s clear, plain language, comprehensible and not misleading for consumers. It must include key facts and risks specific to the product or service.

- The disclosure must be produced in an accessible, durable, storable format, and its digital version must be made available on the product webpage if the product information is available online.

- The disclosure, print and digital, must include the items below, which must be communicated in plain language using a font size no smaller than 11 pts and be compliant with applicable legal requirements.

- test identifier (e.g., name of the test, or agreement number)

- approved testing period

- a statement that the product or service is Part of a FSRA-approved test to support innovation and that the test may be terminated by either the TLE Participant or FSRA prematurely.

- the specific practice being tested and in what way such a practice differentiates from standard practices

- agreed-upon safeguards (from the Testing Plan)

- what impacted consumers should expect in the event of test termination (alternative offering or arrangement in the Testing Plan)

- specific contact person (if different from the Participant’s regular customer service contact)

In addition to the Testing Agreement, in Part B of a Testing Plan, FSRA may impose additional consumer protection safeguards. Possible safeguards may include but are not limited to:

- restricting the allowed monetary amount per transaction

- determining the permitted number of consumers or clients or minimum criteria (e.g., level of knowledge or experience in similar financial services, exclusion of specific vulnerable consumer groups) eligible consumers must meet

- limiting the test to be carried out in a particular geographical region within Ontario

- restricting the allowed frequency of transactions within a defined period or initiated by one party in the transaction

Processing and responding time expectations

Given the complex nature of TLE applications and tests, opportunities for dialogue between FSRA and the Applicant to improve or recalibrate technical details are built into the TLE processes. This dialogue can occur through or with written correspondence as submission and confirmation. The below expectations for each exchange will be observed with best efforts to ensure timely processing of innovation opportunities:

- An Applicant (or a TLE Participant) generally can expect a response from FSRA approximately 45 calendar days starting the day when the Acknowledgement of Receipt (AOR) concerning the Application or correspondence in question is issued.

- FSRA expects an Applicant (or a TLE Participant) to respond to FSRA’s requests for additional, improved, or revised information and produce such requested information within 45 calendar days starting when a written request is delivered or deemed delivered to an Applicant (or a TLE Participant).

- limitations:

- Accommodations (e.g., extensions) regarding responding time can be made upon request.

- FSRA may deem an Application or an ongoing test aborted by its corresponding Applicant or TLE Participant if no response or request for accommodation is received within the expected responding time.

Responsible innovation through transparency

To uphold the ‘responsible innovation’ principle in contemplating proposed innovation opportunities, FSRA will generally publicize factual information on FSRA’s handling of received innovation opportunities for the public good, such as:

- on what date a TLE application was received, processed, admitted or archived by FSRA

- what (i.e. name of the product, service, or business model) is proposed to FSRA for contemplation

- decisions made by FSRA to admit, decline, terminate, conclude, approve (for future use) or otherwise on a TLE application or test, as well as necessary rationales leading up to those decisions

FSRA will protect any information received about the proposed innovation opportunity to the extent permitted by law. FSRA cannot guarantee that it will not be required by applicable legal obligations to disclose information arising out of or relating to the proposed innovation, such as the Freedom of Information and Protection of Privacy Act.

Appendix 2 – Guide to applications for auto insurance exemptive authority TLE

Purpose of appendix

This Appendix outlines how FSRA will administer a test and learn environment (TLE) and how it will issue exemption order(s) pursuant to subsection 15.1(1) of the Insurance Act (the Act). The processes and practices described in this Appendix supplement the general approach described in the body of this Guidance.

Scope

This Appendix applies to all entities seeking an exemption order under s. 15.1(1) of the Act (see Schedule 1). Under s. 15.1(1) of the Act FSRA may, if not prejudicial to the public interest, make an exemption order from the legal requirements found in Schedule 1 of this Appendix[3].

Applicants wanting to test an innovative consumer-focused auto insurance solution that falls outside the scope of the exemption order(s) permitted under s. 15.1(1) of the Act are encouraged to contact FSRA.

Application details

FSRA’s Innovation Process described in the body of this Guidance will apply to applications for this specific TLE under s. 15.1(1) of the Act. Applicants should indicate that their application is for the Auto Insurance Exemptive Relief specific TLE program and provide required details in the “Specific TLE Relevance and Required Details” column. In addition to the information outlined in Appendix 1 of this guidance, FSRA will collect the following information at the application intake stage:

- Section 15.1(1) Exemption Request: Identification of the legal requirement(s) (set out in Schedule 1) that are the subject of the Applicant’s requested exemption order, and an explanation of how the the proposed innovation/test promotes flexibility.

- Compliance: Confirmation from the Applicant that the innovation opportunity, if approved, will comply with other legal requirements (applicable legislative/regulations/rules) and any best practices or expectations set out in FSRA’s Guidance applicable to automobile insurance. If an Applicant feels that certain best practices or expectations should not apply to the Applicant then those must be specifically identified in the application.

- Data and Reporting: FSRA will request information on metrics for testing the innovation opportunity. Data requirements will vary depending on the innovation and exemption sought (see Schedule 2 for illustrative examples of the types of data requirements).

Duration of testing period

FSRA retains the right to define the length of the testing period granted in the exemption order, up to a maximum of two years as defined by regulation.

Applicants who need additional time at the conclusion of the initial testing period may make a request to FSRA to renew the exemption order, up to a maximum of two more years. Such Applicants will be required to answer any questions posed by FSRA.

FSRA may in its sole discretion shorten the initial or renewed testing period requested by the Applicant.

Schedules

Schedule 1: Overview of Exemptive Authority Under s. 15.1 of the Act

Schedule 2: Data Reporting Requirements

Schedule 1: Overview of exemptive authority under s. 15.1(1) of the Act[4]

This schedule summarizes the legal requirements that are subject to an exemption order under s. 15.1(1) of the Act. Applicants may only seek an exemption order under this Appendix for the following requirements.

|

Name of exemption |

Regulatory/Legislative Requirement referenced in Regulation Exemption Orders Under Section 15.1 of the Act |

Brief Summary of Requirement |

|---|---|---|

|

Requirement to use an approved form under subsection 227(1) of the Act.

Relief from the deeming effect of the Act in relation to s.268 (1). Requirement in respect of the form of documents under section 66 of Ontario Regulation 34/10 (Statutory Accident Benefits Schedule – Effective September 1, 2010). |

Insurers shall not use an application for insurance, a policy, endorsement or renewal, a claims form or a continuation certificate in respect of auto insurance unless FSRA has approved it.

Certain forms related to accident benefits claims (such as a treatment and assessment plan or a treatment confirmation form) shall be in a form approved by FSRA. |

|

Relief from the deeming effect of the Act in relation to s.268 (1).

Requirements in respect of the times when benefit statements must be delivered under subsection 50(4) of the Ontario Regulation 34/10 (Statutory Accident Benefits Schedule – Effective September 1, 2010). |

Insurers must send benefit statements to accident benefits claimants once every two months, or once a year if the claimant is catastrophically impaired |

|

Requirements in respect of group marketing plans set out in section 16 (5)[5] and 17 of Regulation 664 (Automobile Insurance). | Insurers must adhere to certain requirements when marketing auto insurance to members of an organized group. |

|

Section 231 of the Act[6]. | Forbids car dealers, insurance agents and insurance brokers from acting as the agent of an applicant for the purpose of signing an application for automobile insurance |

|

Section 236 of the Act. | Auto insurance renewals with changes from the previous terms must be sent a certain number of days in advance to either the named insured (30 days) or broker (45 days). |

|

Section 439 of the Act, but only in respect of an unfair or deceptive act or practice that is described in paragraph 7 or 12 of section 1 or paragraph 1, 2, 3 or 8 of subsection 2(1) of Ontario Regulation 7/00 (Unfair or Deceptive Acts or Practices) and only in respect of automobile insurance. | Specific prohibited practices: |

Schedule 2: Exemptive authority data reporting requirements

Overview

FSRA will take an adaptive and outcomes-focused approach to administering its authority under s. 15.1(1) of the Act. Data reporting during intake, testing, and on completion of the participation period are fundamental to building a well-developed testing plan (i.e. clear objectives that focus on success of the outcome and consumer benefits).

Once FSRA receives a completed application, it will work with the Applicant to define data reporting requirements on a case-by-case basis depending on the details of the specific innovation. The data reporting requirements outlined in this Schedule are meant to – with the exception of consumer data – align with Applicants’ existing data collection activities. Applicants may provide their analysis, research or reports to meet FSRA’s requirements. Applicants concerned about their capacity to meet these requirements should contact FSRA.

Illustrative examples of project-specific data reporting as per exemptive orders

Examples of some of the data reporting requirements corresponding to each item in Schedule 1 are outlined below. In addition, FSRA may request data that allows for a comparison of consumer outcomes in the testing environment and consumer outcomes under the status quo.

|

Name |

Data Reporting Examples |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Appendix 3 – Guide to TLE applications requesting FSRA exercise regulatory discretion

Purpose of appendix

This appendix (the Appendix) outlines the process to be followed by an Applicant requesting that FSRA exercise regulatory discretion[8] to facilitate an innovation opportunity. Such processes and practices are supplementary to the general approach described in the body of this Guidance.

Scope

This Appendix applies to Market Participants requesting that FSRA exercise regulatory discretion under FSRA’s sector statutes, their regulations and/or FSRA rules.

Application details

FSRA’s Innovation Process described in the body of this Guidance applies to applications for this specific TLE vehicle. A Market Participant requesting that FSRA exercise regulatory discretion should prepare an application package by:

- Completing the separately released Standard Application Form (sector-agnostic),

- Providing additional details in the “Specific TLE Relevance and Required Details” column or in separate appendices:

- cite the provisions of applicable statutes, regulations, and/or FSRA rules pursuant to which the applicant is requesting FSRA exercise regulatory discretion, and if requested by FSRA, provide a legal opinion that the exercise of such discretion is appropriate and reflects an outcome consistent with FSRA’s statutory objects under the Financial Services Regulatory Authority of Ontario Act 2016

- how and why, in the Applicant’s view, the activity promotes desired consumer outcomes, with the Applicant’s estimate and rationales supporting such view and any available evidence

- broad categories of directly relevant data sets or types of evidence proposed by the Applicant that can be feasibly collected and reported for the purposes of validating the Applicant’s view with planned occasions (e.g. point of quote, sales, cancellation, renewal, et al) for such data collection

- Confirming that, if requested by FSRA, the Applicant will, at its own expense and in accordance with applicable privacy laws, hire an independent third party to:

- collect consumer feedback on matters specified by FSRA with respect to the innovation opportunity

- aggregate this feedback and provide it to FSRA in a form that FSRA deems acceptable

- An undertaking that, if this proposed innovation opportunity is admitted into the TLE, the Applicant will comply with applicable legal requirements and the testing agreement, while ensuring that business practices beyond the scope of the test remain compliant with legal requirements and guidance.

- An undertaking that the Applicant has the technical capability to collect data and perform reporting as stipulated by the testing agreement.

An Applicant should work with FSRA to improve and finalize the application package and confirm admissibility in the application improvement step as defined in the general approach in the body of this Guidance. FSRA may then deliver the decision of TLE admission through formal correspondence, along with an announcement made on FSRA’s website.

Effective Date: December 1, 2023

Last updated: January 15, 2023

[1] Both the CEO of FSRA and FSRA may exercise regulatory authority under the Act. However, for the purposes of this Guidance, reference will only be made to FSRA as the CEO may delegate his/her regulatory authority to FSRA staff, as permitted by s. 10(2.3) of the Financial Services Regulatory Authority of Ontario Act.

[2] Items (l), (m), and (n) complements the data collection and analytics requirements in the Guidance.

[3] Both the CEO of FSRA and FSRA may exercise regulatory authority under the Act. However, for the purposes of this Guidance, reference will only be made to FSRA as the CEO may delegate his/her regulatory authority to FSRA staff, as permitted by s. 10(2.3) of the Financial Services Regulatory Authority of Ontario Act.

[4] Applicants should use this Schedule only as a tool to guide them in preparing their application and should always refer to the actual reg/leg provision for detailed information.

[5] FSRA only has the authority to issue exemption(s) orders under s.16(5) of O.Reg 664 as they pertain to the minimum number of members (i.e. 100 members) required to be considered an organized group.

[6] FSRA only has the authority to issue exemption(s) orders under s.231 of the Act in the context of subscription based automobile insurance.

[7] Paragraphs (7) and (12) of s.1 and paragraphs (1), (2), (3) and (8) of s.2(1) of O. Reg. 7/00 (the UDAP Regulation) are expected to be revoked if Proposed Rule 2020-002 Unfair or Deceptive Acts or Practices (UDAP) (the Proposed Rule) comes into force. If the Proposed Rule comes into force, FSRA does not anticipate having exemptive authority under s.15.1(1) of the Act for the Proposed Rule.

[8] Both the CEO of FSRA and FSRA may exercise regulatory authority under sector statutes. However, for the purposes of this Guidance, reference will only be made to FSRA as the CEO may delegate authority to FSRA staff, as permitted by s. 10(2.3) of the Financial Services Regulatory Authority of Ontario Act.